About Our Course Director

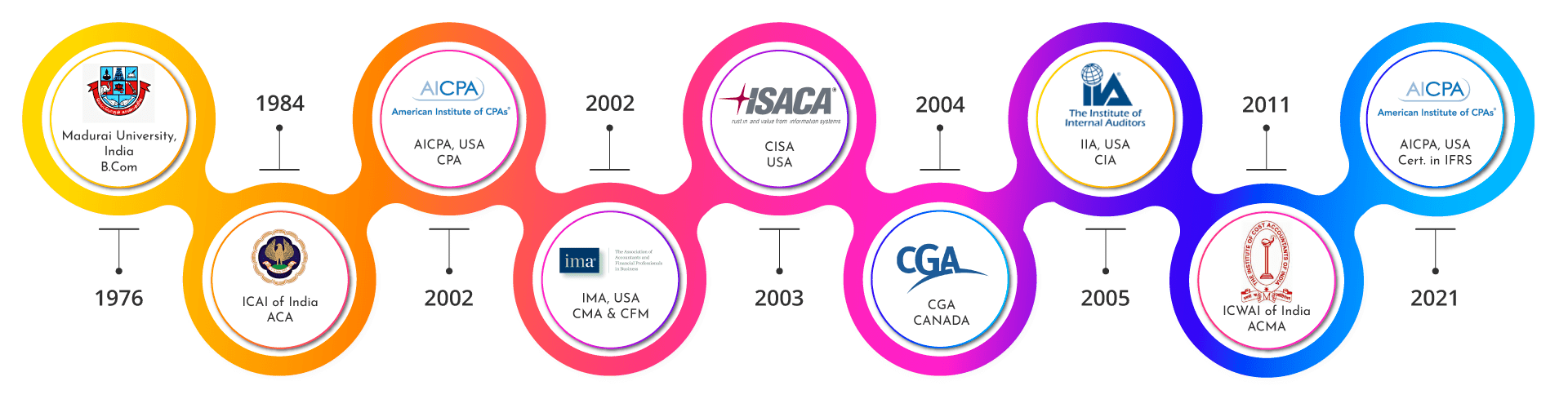

Professor Hariharan D. graduated from Madurai University and passed a professional examination in accounting from India, USA, and Canada. He has above 25 years of top management experience in finance & accounts functions and 15 years of teaching experience in professional courses.

“Pursuit of Passion Blended with Professional Education and Industry Experience”

-

Graduate from Madurai University

-

Passed professional examinations from India, USA and Canada.

-

25 years of top management experience.

-

Gave up his job to pursue his dream of imparting knowledge.

-

15 years experience in preparing students for CPA/CMA/CIA/CISA Examination.