CERTIFIED PUBLIC ACCOUNTANT

(CPA U.S.A)

Complete Before Changes catch you in 2024

“Foundation of Global Accounting Career Opportunity”

Overview

CPAs are trusted financial advisors who help business and other organizations plan and reach their financial goals. They are qualified to handle wide variety of business functions including Chief Financial Officer, Chief Executive Officer, Financial Director as well as consultancy roles.

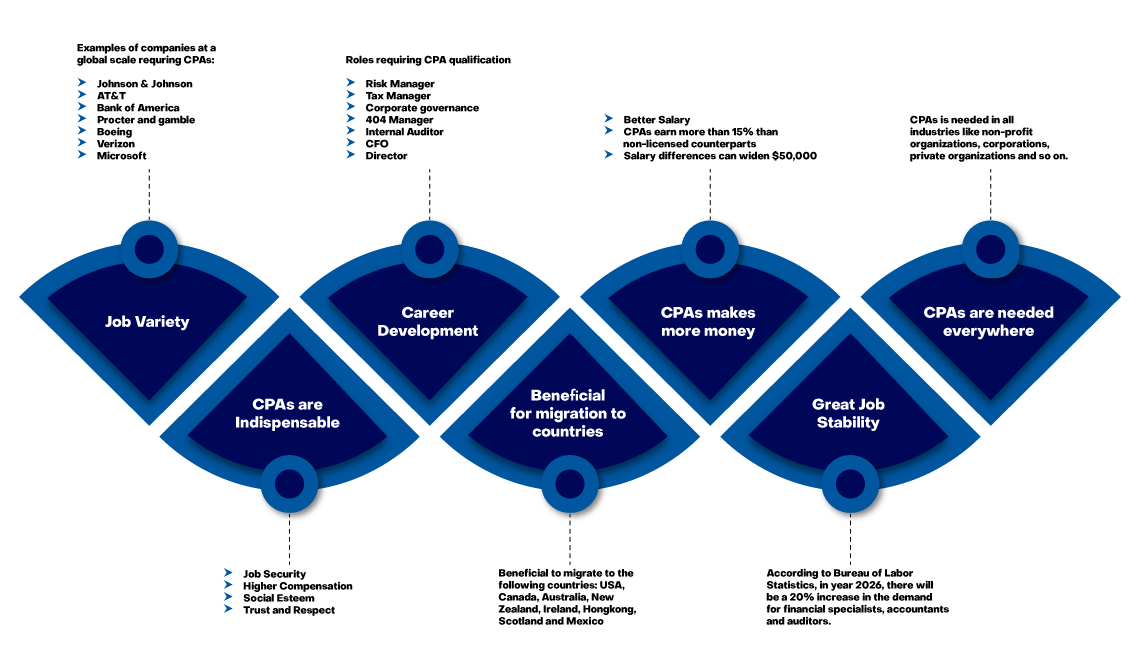

Global CPA Recognition

- CPA is a professional certification from United States of America and professional pride for finance professionals.

- CPA is recognized throughout the U.A.E job market and in multinational corporations.

- CPA qualification is mutually recognized by professional institutes in Canada, Australia, New Zealand, Ireland, Hong Kong, Mexico and Scotland.

- This will ease up the migration to other countries.

Certification Issued By:

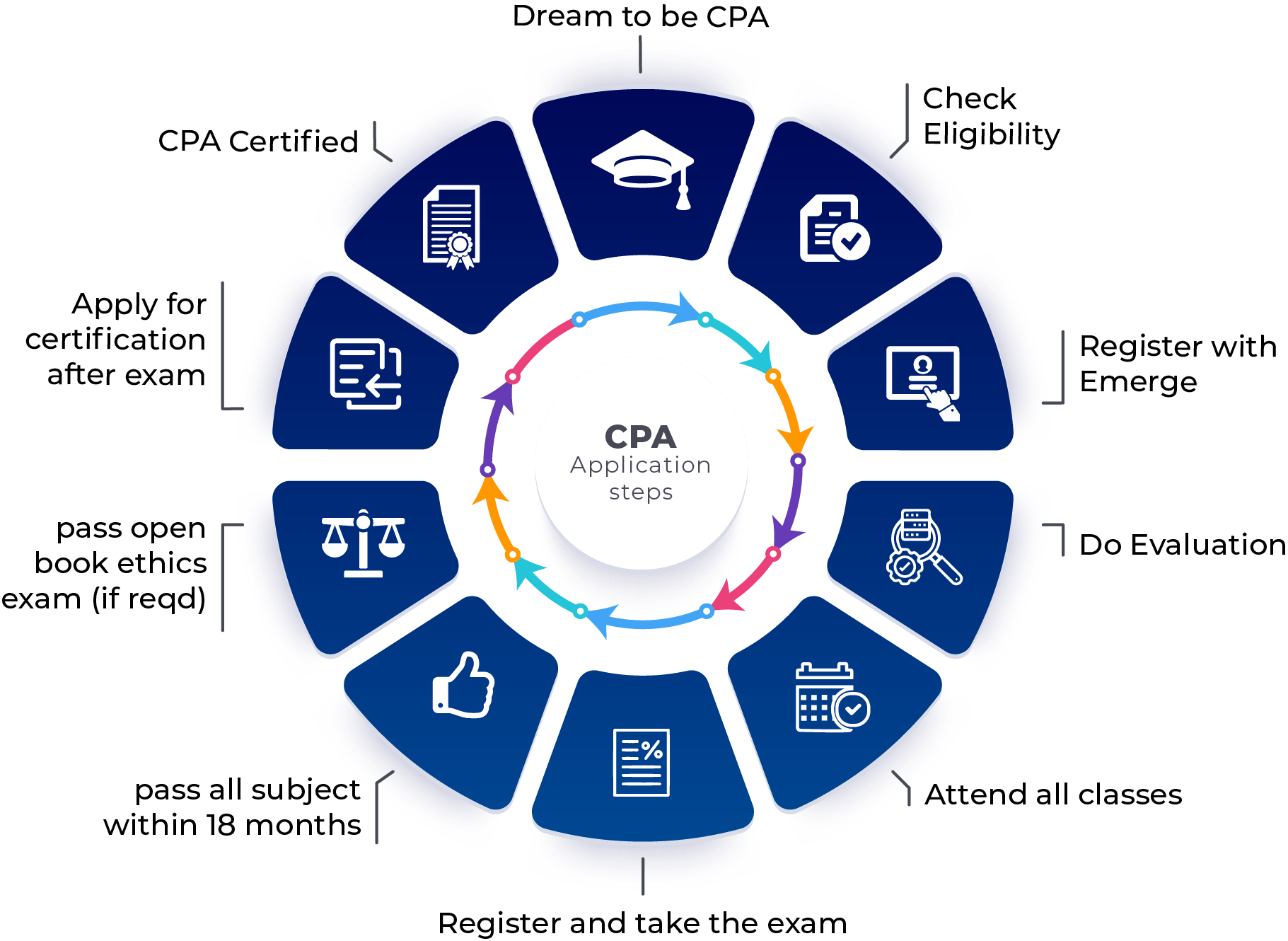

State Board of Accountancy from applicable State on attaining the following 3 E’s

- Education: 120/150 semester hours of education

- Examination: Pass the Uniform CPA Examination

- Experience: Requirements vary state by state. Some states recognize private experience outside of the USA.

CPA Examination Conducted By:

- American Institute of Certified Public Accountants (AICPA)

Eligibility

- M.Com / M.B.A. / ICWA / CA are eligible. B.A./ BBA / B.SC graduates (4 years) with accounting subjects are eligible, subject to conditions.

Why CPA?

CPA will provide you with multiple benefits in your personal and professional growth.

Examination Center

Prometric centers in USA, UAE, England, Germany, Scotland, Ireland, Bahrain, Kuwait, Lebanon, Japan, Brazil and India – Subject to conditions.

CPA Exam Syllabus

Core (Compulsion)

Auditing and Attestation (AUD)

| Content Area | Allocation | |

|---|---|---|

| Area I | Ethics, Professional Responsibilities and General Principles | 15–25% |

| Area II | Assessing Risk and Developing a Planned Response | 25–35% |

| Area III | Performing Further Procedures and Obtaining Evidence | 30–40% |

| Area IV | Forming Conclusions and Reporting | 10–20% |

Financial Accounting and Reporting (FAR)

| Content Area | Allocation | |

|---|---|---|

| Area I | Financial Reporting | 30-40% |

| Area II | Select Balance Sheet Accounts | 30-40% |

| Area III | Select Transactions | 25-35% |

Taxation and Regulation (REG)

| Content Area | Allocation | |

|---|---|---|

| Area I | Ethics, Professional Responsibilities and Federal Tax Procedures | 10-20% |

| Area II | Business Law | 15-25% |

| Area III | Federal Taxation of Property Transactions | 5-15% |

| Area IV | Federal Taxation of Individuals | 22-32% |

| Area V | Federal Taxation of Entities (including tax preparation) | 23-33% |

Core (Compulsion)

Business Analytics and Reporting (BAR)

| Content Area | Allocation | |

|---|---|---|

| Area I | Business Analysis | 40-50% |

| Area II | Technical Accounting and Reporting | 35-45% |

| Area III | State and Local Governments | 10-20% |

Information Systems and Controls (ISC)

| Content Area | Allocation | |

|---|---|---|

| Area I | Information Systems and Data Management | 35-45% |

| Area II | Security, Confidentiality and Privacy | 35-45% |

| Area III | Considerations for System and Organization Controls (SOC) Engagements | 15-25% |

Tax Compliance and Planning (TCP)

| Content Area | Allocation | |

|---|---|---|

| Area I | Tax Compliance and Planning for Individuals and Personal Financial Planning | 30-40% |

| Area II | Entity Tax Compliance | 30-40% |

| Area III | Entity Tax Planning | 10-20% |

| Area IV | Property Transactions (disposition of assets) | 10-20% |

CPA EXAM STRUCTURE

Minimum Passing Mark

Passing grade for each section – 75%

Credits for passed papers are available for 18 months

Work Experience

Not required in some states for getting CPA designation (2 tier states)

Required for licensing and differs from state to state

Our Services Include:

■ Gleim Premium CPA Review Materials

► Experts Video Lectures ► Realistic Exam Day Experience

► Audio Lectures ► Access Until You Pass® Guarantee

► Digital & Physical Books ► SmartAdapt™ Intelligently Guided Review

► Digital Notebook ► The Largest Bank of Exam Questions

► Digital Flashcards ► Mock Exam & Final Review Mode

■ Evaluation Assistance ( State and Evaluation Agency )

■ Exam Registration / Scheduling Assistance

■ In Person or Live Interactive Online Class

■ Continuous Progress Assessment

■ Emerge Mock Exams

■ E-Group Membership

■ Instructor’s Notes

■ U.S.A Certified Instructor

■ Highest Passing Rate in the Middle East

■ Support of Instructor Until Passing the Exam

About Exam

|

Paper

|

Subject

|

Exam.

Hrs. |

MCQs

50% |

TBS

50% |

|---|---|---|---|---|

|

Core (Compulsion)

|

||||

|

1

|

Auditing and Aftestation (AUD)

|

4

|

78

|

7

|

|

2

|

Financial Accounting and Reporting (FAR)

|

4

|

50

|

7

|

|

3

|

Taxation and Regulation (REG)

|

4

|

72

|

8

|

|

Discipline (Any One Optional)

|

||||

|

4

|

Business Analysis and Reporting (BAR)

|

4

|

50

|

7

|

|

5

|

Information Systems and Controls (ISC)

|

4

|

82 (60%)

|

6 (40%)

|

|

6

|

Tax compliance and Planning (TCP)

|

4

|

68

|

7

|

MCQ – Multiple Choice Questions | TBS – Task-Based Simulation | WCT – Written Communication Task

|

Other Cost

|

||

|---|---|---|

|

Credential Evaluation Fees

|

$300 to $400

|

|

|

Exam. Fees per Paper

|

$750 (Approx.)

|

|

FREE Eligibility Check

Email us all your Mark Sheets / Transcripts and Certificates

Others

Email: enq@emerge.pro

Tel: +971 4 3521133

Give us a call or drop by anytime, we endeavour to answer all enquiries within 24 hours on business days.